|

Florida Administrative Code (Last Updated: November 11, 2024) |

|

12. Department of Revenue |

|

12D. Property Tax Oversight Program |

|

12D-8. Assessment Roll Preparation And Approval |

1(1) All submitted tapes shall meet the following technical requirements, unless written approval to do otherwise is granted by the Executive Director for good cause shown.

27(a) Character set (display) – EBCDIC (Extended Binary Coded Decimal Interface Code).

39(b) One-half inch standard magnetic tape, 9 track, odd parity, 800, 1600, or 6250 BPI (Bits Per Inch).

57(c) No label records.

61(2) For each submission of tape(s), a transmittal document showing the following information shall be enclosed:

77(a) Character set.

80(b) Density.

82(c) Leading tapemark (yes or no).

88(d) Record layout (if not specified by these rules).

97(e) Record format data elements description (if not specified by these rules).

109(f) The transmittal document for the Standard Name – Address – Legal (N.A.L.) file shall indicate:

1251. Whether effective year built or actual year built is shown for each improved parcel, and

1412. Whether adjusted area or total living area is shown for each improved residential parcel.

156(3) Each property appraiser shall submit a computer tape copy of the following files to the Department on or before the dates indicated. STANDARD FILES are defined under subsection (6) of this rule.

189(a) The STANDARD N.A.L. File: No later than the submission date for the initial real property assessment roll. This file shall contain information current at the time of publication of the initial real property assessment roll, including a computer tape copy of real estate transfer data current to December 31st of the previous calendar year. Upon request by the Department, another submission is required no later than 30 days following extension of the tax rolls pursuant to Rule 26712D-8.015, 268F.A.C.

269(b) The Master Appraisal File, if one exists: No later than the submission date for the initial real property assessment roll. This file shall contain information current at the time of publication of the initial real property assessment roll. The record layout shall be that used locally, provided that the requirements of subsection (1) above are met.

326(c) The previous year standard N.A.L. file: No later than the submission date for the current year real property assessment roll in the event that the county has completely or partially changed parcel numbering since the previous roll other than routine splits, deletions and combinations. This file shall have coded thereon an “alternate key” to facilitate the translation of the old parcel numbers to the new parcel numbers.

394(4) Each property appraiser shall submit a computer tape copy of the following file to the Department on or before the date indicated:

417(a) The STANDARD N.A.P. File: No later than the submission date for the initial tangible personal property assessment roll. This file shall contain information current at the time of publication of the initial tangible personal property assessment roll. Upon request by the Department another submission is required no later than 30 days following extension of the tax rolls pursuant to Rule 47812D-8.015, 479F.A.C.

480(b) The previous year standard N.A.P. file: No later than the submission date for the current year tangible personal property assessment roll in the event that the county has completely or partially changed account numbering since the previous roll other than routine attrition or addition of accounts. This file shall have coded thereon an “alternate key” to facilitate the translation of the old account numbers to the new account numbers.

550(5) In those counties subject to an in-depth review, pursuant to Section 562195.096, F.S., 564and if requested in writing by the Executive Director, the property appraiser shall submit a computer tape copy of the following files to the Department on or before the dates indicated, provided that submission shall not be required earlier than 30 days following mailing of the request by the Executive Director.

615(a) The STANDARD N.A.L. file containing real estate transfer data current to December 31, and all other data current at the time of publication of the revised (extended) real property assessment roll: No later than January 31.

652(b) The STANDARD Deletions, Splits, and Combinations (D.S.C.) File, if one exists: No later than the submission date for the Initial Real Property Assessment Roll.

677(6) Record Layouts for STANDARD FILES. Property appraisers are not required to keep data in the standard file layouts for day-to-day operations. However, they are required to merge and/or reformat their existing files to the standard file layout as appropriate when submitting computer tape materials to the Department.

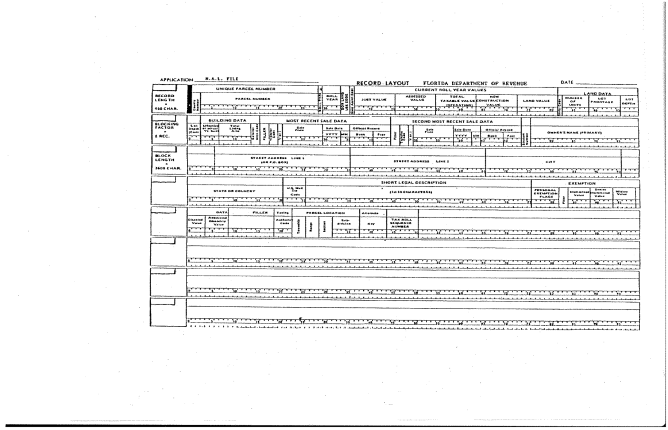

725(a) The STANDARD N.A.L. File shall be formatted as follows:

7351. Record length-450 characters (fixed length).

7412. Block length-3600 characters (8 records per block).

7493. The following is a listing of the STANDARD N.A.L. File and is contained in an example form, Form DR-590 (incorporated by reference in Rule 77412D-16.002, 775F.A.C.).

776Name, Address, Legal (N.A.L.) File

781Field

782Location

783Field7841

785No.

786Field Label

788First

789Last

790Size

791Type

792Comments

7931

794Unique

795Parcel No.

7971

79828

79928

800A/N

801County No.

8031

8042

8052

806N

807Parcel No.

8093

81028

81126

812A/N

813Show 2 digit county code, local parcel number, and space fill the remaining digits to 28

8292

830Roll type

83229

83329

8341

835A

836“R” for real

8393

840Roll year

84230

84331

8442

845A/N

8464

847D. O. R. land use code

85332

85435

8554

856All numeric except for notes and header records

8645

865Special assessment code

86836

86936

8701

871N

8726

873Total just value

87637

87745

8789

879N

8807

881Total assessed value

88446

88554

8869

887N

888Classified use value, including homestead property, if applicable; otherwise just value

8998

900Total taxable value for operating purposes

90655

90763

9089

909N

9109

911New construction value or deletion value

91764

91872

9199

920N

921Signed field; negative value indicates deletion

92710

928Land value

93073

93181

9329

933N

934Classified use value of land, if applicable; otherwise just value of land

94611

947Land units code

95082

95182

9521

953N

954Use land-unit-of-value code here

95812

959Number of land units

96383

96488

9656

966N

967Assume two decimal places for acreage

97313

974Square footage

97689

97797

9789

979N

980Assume no decimal places for square feet

98714

988Improved quality

99098

991100

9923

993A/N

99415

995Construction class

997101

998101

9991

1000N

100116

1002Filler

1003102

1004102

10051

1006A

1007Space Fill

100917

1010Effective or actual year built of major improvement

1018103

1019106

10204

1021N

102218

1023Total living area (or adjusted area) or usable area if non-residential

1034107

1035113

10367

1037N

103819

1039Number of buildings

1042114

1043115

10442

1045N

104620

1047Market area

1049116

1050117

10512

1052A/N

105310 to 30 areas

1057MOST RECENT SALE DATA (through field 26)

106421

1065Transfer code

1067118

1068119

10692

1070N

107122

1072Vacant or improved code

1076120

1077120

10781

1079A

1080“V” or “I”

108323

1084Sale price

1086121

1087129

10889

1089N

109024

1091Date of sale

1094130

1095135

10966

1097N

1098Year

1099130

1100133

11014

1102N

1103Month

1104134

1105135

11062

1107N

110801 through 12

111125

1112O. R. Book

1115136

1116140

11175

1118A/N

111926

1120O. R. Page

1123141

1124144

11254

1126A/N

1127SECOND MOST RECENT SALE DATA (through field 33)

113527

1136Filler

1137145

1138146

11392

1140A

1141Space Fill

114328

1144Transfer code

1146147

1147148

11482

1149N

115029

1151Vacant or improved code

1155149

1156149

11571

1158A

1159“V” or “I”

116230

1163Sale price

1165150

1166158

11679

1168N

116931

1170Date of sale

1173159

1174164

11756

1176N

1177Year

1178159

1179162

11804

1181N

1182Month

1183163

1184164

11852

1186N

118701 through 12

119032

1191O. R. Book

1194165

1195169

11965

1197A/N

119833

1199O. R. Page

1202170

1203173

12044

1205A/N

120634

1207Stratum No.

1209174

1210175

12112

1212N

1213Always “00”; will be assigned by D.O.R.

122035

1221Owner’s name

1223176

1224205

122530

1226A

1227Primary owner

122936

1230Street address line 1

1234206

1235235

123630

1237A/N

1238Mailing address of primary owner

124337

1244Street address line 2

1248236

1249265

125030

1251A/N

125238

1253City

1254266

1255295

125630

1257A/N

125839

1259State or country

1262296

1263320

126425

1265A/N

126640

1267U. S. mail zip code

1272321

1273325

12745

1275N

127641

1277Short legal description

1280326

1281355

128230

1283A/N

12841st 30 characters

1287SOCIAL SECURITY NUMBERS (SSN) OF APPLICANT AND OTHER OWNER (through field 45)

129942

1300Applicant’s Status

1302356

1303356

13041

1305A

1306Applicant’s marital status H=Husb. W=Wife O=Other “H”, “W”, or “O”

131643

1317Applicant’s SSN

1319357

1320365

13219

1322N

132344

1324Co-Applicant’s Status

1326366

1327366

13281

1329A

1330Co-Applicant’s marital status H=Husb. W=Wife O=Other “H”, “W”, or “O”

134045

1341Co-Applicant’s SSN

1343367

1344375

13459

1346N

134746

1348Personal exemption flags

1351376

1352376

13531

1354A/N

1355Use numeric “0” or “A” through “Z”

136247

1363Other exemption value

1366377

1367383

13687

1369N

137048

1371Amount of homestead

1374384

1375388

13765

1377N

1378exemption

137949

1380Amount of widow(er)

1383389

1384393

13855

1386N

1387exemption

138850

1389Amount of disabled

1392394

1393400

13947

1395N

1396exemption

139751

1398Amount of renewable

1401energy exemption

1403401

1404407

14057

1406N

140752

1408Group Number/Confidentiality Code

1411408

1412409

14132

1414N

1415First Character Always “0” will be assigned by Department of Revenue for second character “0” otherwise any confidential parcels should be indicated with code “1”

144053

1441Neighborhood code

1443410

1444417

14458

1446A/N

144754

1448Public land

1450418

1451418

14521

1453A

145455

1455Taxing authority code

1458419

1459422

14604

1461A/N

1462First two digits indicate municipality

146756

1468Parcel location

1470423

1471431

14729

1473A/N

1474Township

1475423

1476425

14773

1478A/N

14792 numeric, 1 alpha

1483Range

1484426

1485428

14863

1487A/N

14882 numeric, 1 alpha

1492Section or Grant No.

1496429

1497431

14983

1499N

1500Right justify

150257

1503Alternate key

1505432

1506444

150713

1508A/N

150958

1510Tax Roll Sequence No.

1514445

1515450

15166

1517N

1518Numbers shall be assigned in the order parcels appear on the assessment roll

1531(1) 1532Field type legend:

1535A

1536=

1537Alphabetic

1538A/N

1539=

1540Alphanumeric

1541N

1542=

1543Numeric

1544(b) The STANDARD D.S.C. File (Deletions, Splits, and Combinations) shall be formatted as follows:

15581. Record Length – 86 characters (fixed length).

15662. Block length – 3440 characters (40 records per block).

1576Field

1577Location

1578Field

1579Range of Values/

1582Number

1583Field Label

1585First

1586Last

1587Size

1588Type

1589Comments

15901

1591Unique

15921

159328

159428

1595A/N

1596No. of each

1599Parcel No.

1601parcel which

1603County No.

16051

16062

16072

1608N

1609splits, is

1611Parcel No.

16133

161428

161526

1616A/N

1617deleted or combined. Show county code in 1st two digits; then local parcel number; then spaces through digit 28.

16362

1637DOR land use code

164129

164230

16432

1644N

1645Use code of above parcel

16503

1651D.S.C. code

165331

165431

16551

1656N

1657Delete = 1; split = 2; combination = 3

16664

1667Total Just Value

167032

167140

16729

1673N

1674Previous roll value of deletion;

16795

1680Total Assessed Value (classified Use Value if appl.; other-wise Just Value)

169141

169249

16939

1694N

1695current roll value if split or

17016

1702Total taxable value for operating purposes

170850

170958

17109

1711N

1712combination (fields 4 through 6).

17177

1718Parent parcel No.

172159

172284

172326

1724A/N

1725If entry applies to splits or combinations. Otherwise, space fill.

17358

1736Parent DOR land use code

174185

174286

17432

1744N

1745If entry applies to splits or combinations.

1752A = Alphabetic

1755A/N = Alphanumerics

1758F = Floating Point

1762N = Numeric

1765(c) The standard N.A.P. file shall be formatted as follows:

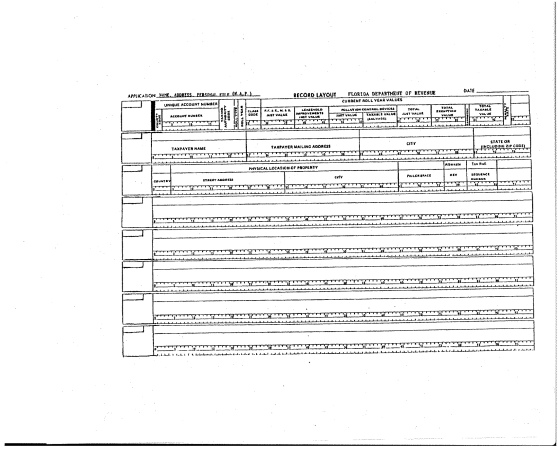

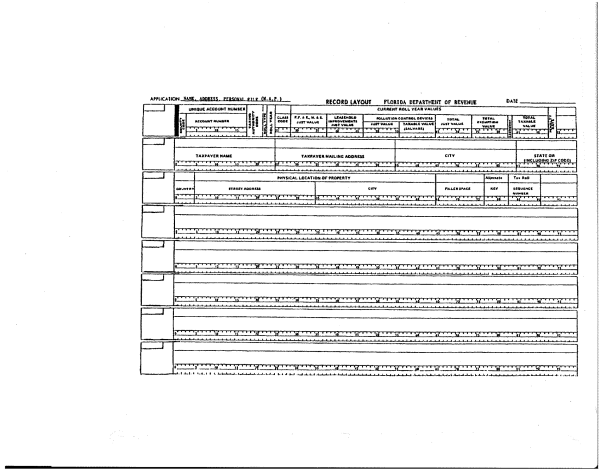

17751. Record length – 290 characters (fixed length).

17832. Block length – 3480 characters (12 records per block).

17933. The following is a listing of the STANDARD N.A.P. File and is contained in an example form, Form DR-592 (incorporated by reference in Rule 181812D-16.002, 1819F.A.C.).

1820Field

1821Location

1822Field

1823Range of Values/

1826Number

1827Field Label

1829First

1830Last

1831Size

1832Type

1833Comments

18341

1835Unique

18361

183717

183817

1839A/N

1840Show 2-digit county code, local account number, and space fill the remaining digits to 17.

1855Account No.

1857County No.

18591

18602

18612

1862N

1863Account No.

18653

186617

186715

1868A/N

18692

1870Taxing Authority Code

187318

187421

18754

1876A/N

1877Same code as used for real property

18843

1885Roll Type

188722

188822

18891

1890A

1891“P” for personal

18944

1895Roll Year

189723

189824

18992

1900N

1901Last two digits of year

19065

1907CSN Code

190925

191025

19111

1912A

1913Flag indicating use of Class (C), SIC (S) or NAICS (N) Codes

19256

1926Class/SIC/NAICS Code

192826

192931

19306

1931N

19327

1933Furniture, Fixtures, and Equipment; Materials and Supplies – At Just Value

194432

194541

194610

1947N

19488

1949Leasehold Improvements Just Value

195342

195451

195510

1956N

19579

1958Pollution

195952

196071

196120

1962N

1963Control Devices

1965Just Value

196752

196861

196910

1970N

1971Taxable Value

197362

197471

197510

1976N

197710

1978Total Just Value

198172

198281

198310

1984N

198511

1986Total Exemption Value

198982

199091

199110

1992N

199312

1994Exemption Type

199692

199792

19981

1999A

2000Alphabetic character to be designated by Department of Revenue

200913

2010Total Taxable Value

201393

201410

201510

2016N

201714

2018Penalty Rate

2020103

202110

20222

2023N

202415

2025Taxpayer Name

2027105

202813

202930

2030A/N

203116

2032Taxpayer Mailing Address

2035135

203616

203730

2038A/N

203917

2040City

2041165

204219

204330

2044A/N

204518

2046State or

2048195

204921

205020

2051A/N

2052Include Zip Code

2055Country

205619

2057Physical Location of Property

2061215

206227

206360

2064A/N

2065Street Address

2067215

206824

206930

2070A/N

2071City

2072245

207327

207430

2075A/N

207620

2077Filler

2078275

207927

20802

2081A/N

2082Reserved for future use.

208621

2087Alternate Key

2089277

209028

20916

2092N

2093See 209412D-8.011(2)(v),

2095F.A.C.

209622

2097Tax Roll Sequence No.

2101283

210229

21038

2104N

2105Numbers shall be assigned in the order accounts appear on the assessment roll.

2118A = Alphabetic

2121A/N = Alphanumeric

2124N = Numeric

2127Rulemaking Authority 2129195.027(1), 2130213.06(1) FS. 2132Law Implemented 2134195.027, 2135195.096, 2136213.05 FS. 2138History–New 12-7-76, Amended 7-17-80, 9-30-82, Formerly 12D-8.13, Amended 12-27-94, 12-31-98, 1-2-01.